Rental #4 I bought a house from across the country that I couldn’t afford, and still made a profit

In 2017 I was antsy to buy another rental, a bit too antsy.

I had bought my previous deal the Summer before in 2016 and I was waiting to cash out on that house before I bought the next, at least that had been the plan. Patience is far from a strength of mine and luckily this hasn’t gotten me in too much trouble, actually, when done right moving fast is quite valuable.

I looked at all my finances and decided that I spent every dollar I had in both my business and personal accounts AND leveraged my HELOC to the max I could scrape by and buy another house. This is also assuming the rehab stayed cheap and no other large expenses happened in the meantime, which is never the case.

So I contacted my realtor anyway and told her I was in buying mode. The leads started coming in and it only took a few short days before I came across a deal I thought I could put together. I saw a few pictures of the property through email, I looked at the numbers and the area and decided it could work. From the pictures the house was awful but the neighborhood was decent

Usually, this process takes 2-3 days at the most. I’ll put an offer in, and I’ll know whether it was accepted quite quickly, so when I didn’t hear anything back (which is common) I assume I didn’t win the bid and went about my business waiting for the next deal. This turned out to be for the best because a week later I had an HVAC failure in one of my units that needed a full repair and some upgrading (it was a very old unit), so $6400 later I was really happy my bid wasn’t accepted because I was so tight on that deal I would no longer be able to afford it. Then OF COURSE about a week goes by and I get a call from the realtor letting me know I won the big, we close in 30 days.

Mistakes have been made

I was terrified, but I took some time to really look at the situation. but I knew I could still afford to write the check for the house if I had to so I kept moving forward. It’s important in real estate to always move forward on deals. If you run away at ever hiccup you don’t get ahead and you don’t learn how to overcome. I learned a TON by moving forward no matter what and learning how to solve problems rather than bailing. The house was a deal, and I knew I had refi money coming in a few weeks. I had exit strategies

Ok let’s see where I was at this point:

- House bid was mine, I intended to close

- House was 2600 miles away, contractor hadn’t seen it yet

- I was ~$6500 short on this deal IF the rehab came in at my lowest expectation.

Here was the strategy I built to get me out of this mess:

IDEAL:

- Get my rehab contractor over there immediately to get final rehab costs

- Start talking to lenders about getting a mortgage for House #3 and use those funds to pay for the costs of this house

- Look for partners/friends/everyone/loan shark who would lend me the fund to bridge the costs

- Use refi funds from house #3 to repay

- Install tenant, make fat stacks

LESS THAN IDEAL:

- Close on house, then sit on it until I build funds to rehab

- Wholesale the house as-is. Basically, I would sell it to a fellow investor to do what I couldn’t

- Bailout of the closing

These are the things that were swirling through my head. As I had spoken with my lender more it seemed that doing a refinance for the last house HOUSE #3 was going to get done smoothly. This gave me some confidence AND provided me some additional risk mitigation when asking for private money.

I had never borrowed private funds before

This was a big deal for me actually as I had never borrowed money from a private source before and it’s there isn’t a massive demand to take the first chance on a guy like, especially when the ask is “hey can you loan me money for this great deal I locked down but didn’t find out I couldn’t afford it until AFTER”. People would probably describe me as arrogant, obnoxious, and intense, these are not qualities that make new investors want to fork over cash. Maybe this is a bit of an exaggeration, I’m not totally polarizing, more of an ‘acquired taste’. In all honesty I did have a few things working in my favor:

- I spent a few years in sales and I got pretty good at it

- The deal I had was solid

- The loan would only be for a short-term

- The amount I needed wasn’t an unreasonable amount

- I had skin in the game, so I set off to ask around.

So with this in mind I prodded and poked a few people I thought might be interested with zero success until I got to Frank. Frank and I met online at www.biggerpockets.com about a year ago. We had become really good friends through the site and hanging out in person, I introduced him to local resources and we met regularly to talk real estate and personal finance. I explained to him the numbers on this deal, the risks, and my exit strategies, just like I did in this post. He knew I could pull it off, and he trusted me since I had just helped him lock down a similar unit earlier this year and I didn’t ask him for any fee. Just from our conversations I knew he probably had a bit of cash he could part with at least temporarily so I pitched him the idea and he was quite receptive. We negotiated terms, he agreed, and he wired me $20,000 in a few days. This was both a big step for this deal, but also for what I started thinking I can accomplish next. The ability to raise private capital could open all new doors of opportunity.

The Rehab:

This house was such a dump. It was ugly, beat to hell, and it had very few positive characteristics. As the pictures started coming in I knew it was worse off than I had originally thought, but I was feeling better that progress was being made

It literally had growth coming through the walls

The house needed all of the standard stuff I knew about and that we do with most houses. Paint, floors, cabinet painting, landscape, etc. What it also needed was a whole new HVAC, new roof, new driveway, and we converted it to 4/2 rather than keeping it the 3/1.5 that it started. This is going to set our rehab WAY over budget. This is bad news in the short run but not terrible news in the long run as long as I can still come out profitable. I don’t mind paying for capital expenditures up front if I have to, but if I can defer costs that’s always ideal. Why pay today for an expense today when I can pay the same for that expense down the road where I’ll be in better financial condition to absorb the cost.

Wrapping up:

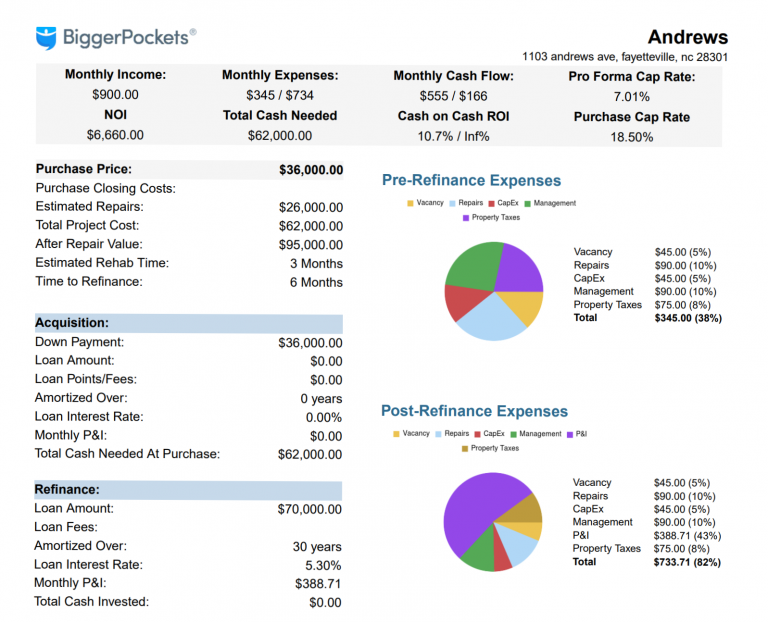

The house was purchased for $36,000 and ended up needing about $26,000 for repairs. This is WAY over what I had expected to pay out, and it’ll all be ok. First off the bulk of the unknown cost came from CapEx that I knew weren’t far out to replace anyway. Basically, when I bought the house I knew it would need a roof and HVAC and I was HOPING I could defer these costs for ~24 months or so, this would allow me time to receive rent income ahead of the expense. Sadly I had to replace both during rehab, this means for cash outlay I had to put out more now, but this also means no roof/hvac/capex costs for a LONG time down the road.

I paid Frank back in 60 days exactly, I was able to do this because I had done a cash-out on the previous house HOUSE #3 during this rehab. Worked out perfect, he was happy and I paid him a big bonus for the help and now I’m poised to ask him for more the next time (and coming soon hopefully!)

This wasn’t a great deal, to be honest; it was a good one but not a great one. I certainly paid a premium for being so far away and moving forward so arrogantly. I plan to fix this with the next deal by including my contractor much closer in the process. I’m thankful that my contractor’s goals and mine are closely aligned (not by accident, by design) so it’s in his best interest to make sure I’m as profitable as possible. If I had been a little more diligent and strict on this deal I could have saved money or found a better one. That said, I would do this deal over and over again if I had the chance.

Buying a house for many people is terrifying, buying one across the country must be worse, and buying one across the country and then finding out you can’t afford it should be debilitating right? Hopefully, this story makes it seem less scary. Fear is usually fear of the unknown, but this can be largely mitigated by KNOWING what can/will happen. Education is a valuable way to mitigate risk because thoroughly understanding a situation makes you less scared of it and also allows you to more accurately account for and deal with potential hazards. This is why I wasn’t too scared to get this deal done, I knew the risks and how to account for them. Next time you’re scared of taking a risk, just learn as much as possible about the situation and you’ll be surprised how much more confident it can make you feel.

After pics